Republican Congressmen in the House and the Senate have introduced legislation that would prevent federal employee retirement funds from being invested in entities that focus upon environmental, social, and governance (ESG) criteria, as well as diversity, equity, and inclusion (DEI) metrics.

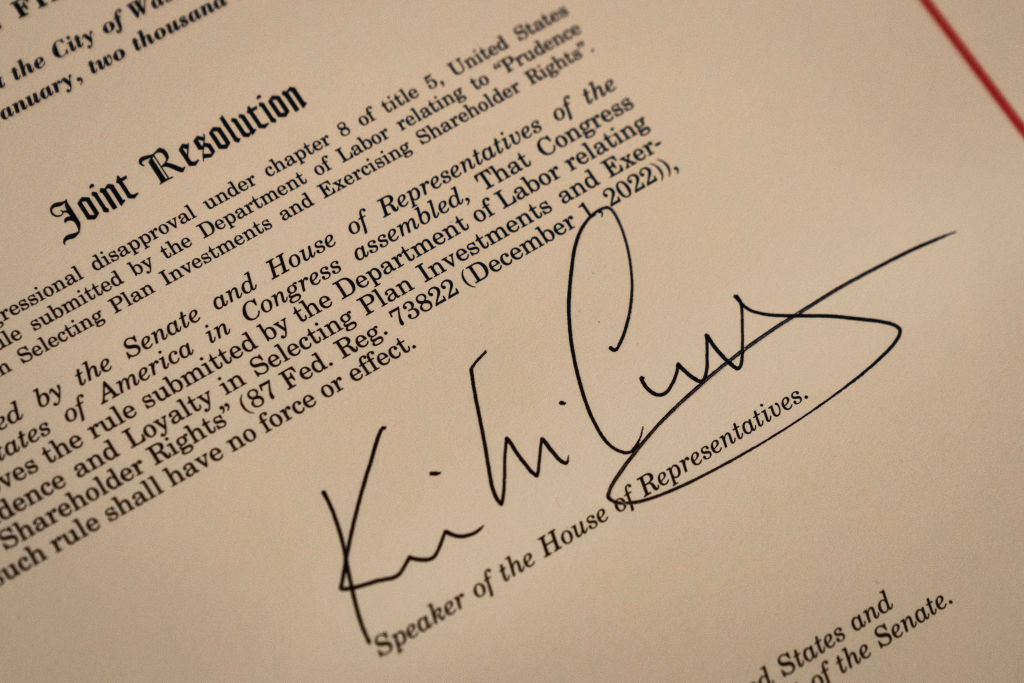

The initiative, known as the Stop TSP ESG Act, was led in the Senate by Ted Cruz (R-TX) and Eric Schmitt (R-MO), Rep. Ken Buck (R-CO) led the effort in the House of Representatives.

The lawmakers’ move comes in response to bias in favor of funds and companies that champion ESG and DEI policies, with gigantic asset management companies such as BlackRock and State Street leading the charge. Critics allege that such firms are leveraging federal retirement funds to advocate for their “woke” agendas.

Sen. Cruz emphasized this concern, stating, “As the managing entity of TSP, BlackRock is leveraging the financial weight of the federal retirement system to push their woke ESG and DEI ideology through other peoples’ investments. BlackRock’s manipulation and brazen politicization of federal retirement accounts is wrong and should not be tolerated.”

If passed, the bill would prevent federal retirement funds like the Thrift Savings Plan (TSP) from outsourcing its corporate voting power to “woke hedge funds.” Rep. Buck further illustrated this point, saying the bill would help curb the influence of large institutional investors, such as BlackRock, who “outvote” smaller, individual investors.

The proposal comes amid heightened focus on ESG and DEI policies at the federal level, with the Department of Labor modifying rules to favor these standards. This specific rule prompted legal action from 25 states.

Individual states have represented the most powerful anti-ESG movement to date. State legislators and governors, in tandem with state legal and financial officers, have asserted that ESG policies are discriminatory, anti-American, and follow reckless fiduciary practices, and have taken strong action to prohibit their use. Texas and Florida have passed some of the most stringent anti-ESG measures, with more states soon to follow their lead.

Despite these developments, the proposed bill is likely to face strong opposition from President Biden’s administration, which supports ESG and DEI policies.